Stats on Business Ownership Effect on Wealth Gap

May 15, 2024Breaking Down Asset Types by Race

At New Majority Capital (NMC), we are fully dedicated to bridging the racial and gender wealth gap by empowering underrepresented entrepreneurs through business ownership. We're hyper-focused on this because the time is now. The "silver tsunami" of retiring business owners presents a historic opportunity to make a significant dent in this intractable problem. It's time to seize this opportunity and equip underrepresented entrepreneurs with the skills, funding, and resources needed to acquire profitable small businesses.

Why Business Ownership Matters:

The recent research by Peter Ciurczak for the Racial Wealth Equity Resource Center (RWERC), a special initiative of Boston Indicators at The Boston Foundation, underscores why this mission is crucial. Some key takeaways:

-

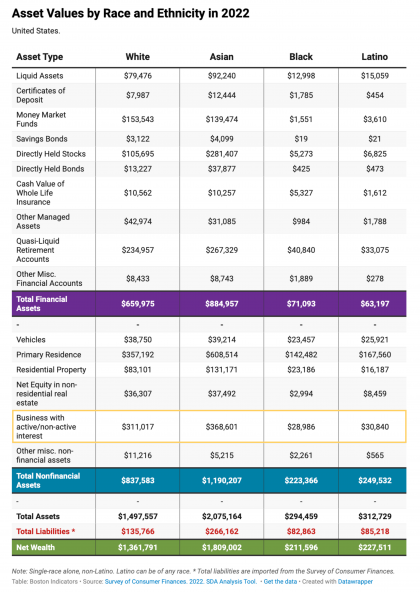

Disparity in Business Asset Value: Black and Latino households hold only $0.08 to $0.13 in business assets per dollar of net worth, while White and Asian households maintain around $0.20 per dollar. This reveals a significant gap in business ownership that, while highlighted in Boston, reflects a broader national wealth disparity.

-

Leverage Potential of Business Assets: While most people recognize the wealth-building potential of real estate investments, business ownership is often overlooked as a viable path that can precede and even fuel real estate acquisitions. The lower proportion of business assets in Black and Latino net worth highlights their limited access to ETA and business ownership opportunities. Business ownership generates income streams that can be reinvested into other avenues, like real estate, stocks, or retirement plans, fostering long-term wealth growth.This aligns with anecdotal evidence we've gathered from conversations with hundreds of retiring business owners over the past several years, where we've seen firsthand how cash flows from small businesses have enabled them to invest in other wealth-building assets.

-

Access to Ownership is Key: While not conclusive alone, the correlation between business asset ownership and net worth suggests that beyond salaries and good jobs, business ownership can be pivotal in reducing the wealth gap. By providing pathways for underrepresented entrepreneurs to access funding, resources, and training, they can leverage business ownership to generate cash flow and build financial security and generational wealth.

Find Peter Ciurczak's research at RWERC.

Asset ownership and removing barriers to it is clearly the way foward to closing the wealth gap. Join New Majority Capital with our innovative approach to solving this problem.